In this recent Talking Shop episode, co-hosts Erin Moran and David Lively tackle a big topic: What is the optimal fundraising portfolio size?

The answer, as with most answers to the questions Dave and Erin confront, is: It depends. When it comes to optimal fundraising portfolio management, Dave quotes his friend Ben Porter, Chief Advancement Officer at Dartmouth’s Tuck School of Business: “If you’ve seen one university, you’ve seen one university.”

Most organizations roughly follow the “Robert Dunbar” approach and stack major gift officer portfolios with about 150 prospects. At Northwestern, David and his team shrunk portfolios to about 40 prospects and have experienced excellent results. And at EverTrue, we partner with tech-enabled fundraisers to have 1:1 contact every year with 1,000 prospects.

While decisions about the number of prospects in gift officer portfolio vary (and depend on factors like business rules for assigning prospects, prospect rating criteria, logistics of assigning prospects to portfolios, etc.), when we dig into the data on portfolio health, there is a common theme that arises:

Optimal fundraiser portfolios should contain folks that will be solicited (like, actually asked for a gift) within the next 36 months.

This theme points to a few action items around donor portfolio management and optimization:

- To align with the “solicitable within 36 months” criteria, portfolios have to be more fluid and dynamic than they are at most shops.

- There needs to be a good way of cultivating the prospects just outside of gift officer portfolios (a.k.a. build major gift pipeline).

- Remember the Three Ps: People Perform well with good Processes.

Let’s go back to the aforementioned “portfolio health” data.

In April 2023, EverTrue analyzed the previous year’s major gift officer activity, specifically looking at meetings, interactions, and contact reports. We found that the overwhelming majority of constituents assigned to a frontline fundraiser received minimal one-on-one interactions.

In the past year…

- 1.06% of constituents are assigned… less than 2% at pretty much every institution.

- 8 of 10 assigned prospects did not have a meeting.

- 70% of assigned prospects had fewer than 3 touchpoints.

- 35% of assigned prospects had ZERO interactions.

When David Lively first arrived at Northwestern University, he evaluated portfolio data across seventeen Major Gift Officers, and he unearthed similar stats.

- 45% of managed prospects with capacity to give over $1MM had not been seen in three years.

- 55% of managed prospects with capacity to give six-figure gifts had not been seen in three years.

- 65% of the prospects in these portfolios had not been visited over the course of a full fiscal year.

(Side note: Looking at these numbers, ironically, the prospects in the “bottom third” of MGOs portfolios received a worse donor experience than most $100 annual fund donors due to the fact that, as managed prospects, they were often removed from most alumni event invitations and broadscale annual appeals. To the university, they were seen as “too special” to be placed in mass communication streams. But to them? They weren’t even special enough to get an email.)

Fundraisers aren’t at fault for these levels of portfolio activity. It’s simply a question of numbers. There aren’t enough hours in the day to develop authentic relationships using traditional methods with all the prospects in a typical gift officer portfolio, let alone the great prospects who are unassigned.

Three ways to address portfolio purgatory and optimize fundraiser portfolios

1. Dynamic portfolios and fundraiser focus

In response to the prospect portfolio purgatory problem, Northwestern shrunk MGO portfolios to ~40 prospects. Every prospect within an MGO portfolio required an ask within 36 months (and ask amount, ask date, expected close date, and designation).

After honing in on every MGO portfolio, in a two-year period the same 17 fundraisers increased their number of asks by 170% and their number of gifts by 211%, and their collective dollars raised rose by 595%.

At Northwestern, fundraisers can release prospects that don’t fit these criteria into the “open prospect pool” for management by other fundraisers (and event invitations, annual appeals, etc.).

David Lively found two of Northwestern’s largest donors to-date in the pool of previously-managed-but-long-overlooked donors who were released from MGO portfolios after the new portfolio criteria were implemented.

Now, at Northwestern, MGO portfolios operate on a much more dynamic prospect in-and-out process. If a fundraiser can’t actively solicit a prospect within the next 36 months, they are released from assignments; put back into the “warming” channels of event invitations, appeals, and annual giving outreach; re-analyzed by the prospect research team; and available for other fundraisers to cultivate.

2. Warm the pipeline

Our Donor Experience partners across the country employ tech-powered Donor Experience Officers who cultivate relationships with 1,000 donors each (8x the size of most MGO portfolios). With EverTrue’s tech suite and coaching, DXOs build relationships with each of these long-overlooked prospects by reaching out to about 25 new prospects a day, and continuing consistent, personalized touchpoints called “cadences.”

Each morning, EverTrue supplies DXOs with a list of prospects to contact along with clear insights into that person’s giving history, engagement, and interests. This makes it easy for DXOs to tailor a custom message for every prospect — whether it’s an email, phone call, text, social media message, or meeting — and continue to consistently reach out to reengage them.

Our Donor Experience partners have seen incredible ROI as a result of this tech-powered, high-volume, personalized outreach:

- Across our partner institutions, more than half of prospects in DXOs’ fundraising portfolios had never met 1:1 with a fundraiser before.

- Prospects assigned to a DXO increased the number of meetings by 70% from FY20 to FY22.

- On average, our DX partners saw a 46% increase in revenue from 2021.

- Our top-five performing institutions raised 83% more year-over-year.

Donor Experience programs are propelling pipeline and cultivating relationships with donors who were previously lying fallow in gift officers’ portfolios or falling through the cracks of broadscale annual fund messaging.

3. Master the prospect handoff with a good process

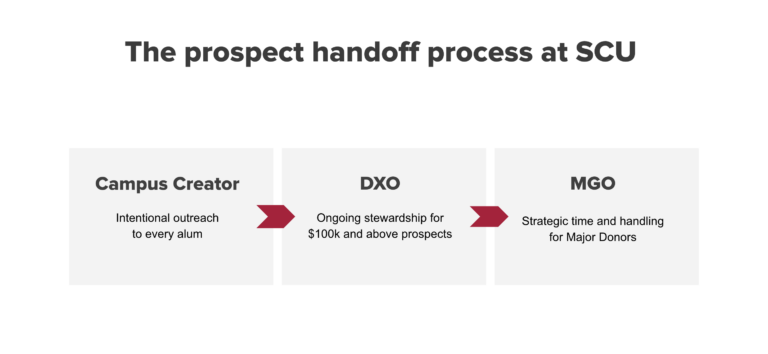

Over the last year, the Santa Clara University team has done phenomenal work towards building a strategic prospect handoff process so that all of their people can perform well.

At a glance, here’s how it looks: Student ambassadors (titled Campus Creators) send personalized video updates from campus to annual donors. When alums engage with those videos (watch the videos and/or respond), they are handed over to Donor Experience Officers (DXOs) for further 1:1 outreach via video, email, phone, and Zoom meetings. When a donor signals their intention and capacity to give at the major gift level, DXOs loop in MGOs to discuss planned gifts, multi-year endowments, and longer-term gift conversations. And when the circumstances are right, prospects are moved from DXOs to MGO portfolios.

Through this new team structure and strategy, the Santa Clara team intentionally built a prospect handoff process to engage long-overlooked donors; deliver a personalized, 1:1, authentic engagement experience; and have deeper conversations about impact and philanthropy with qualified donors when the timing is right.

Tune in!

Catch Episode 7 of the Talking Shop podcast, “Optimal Fundraiser Portfolios” on which co-hosts David Lively and Erin Moran discuss optimal fundraiser portfolios, gift officer focus, and cultivating pipeline.